Picture this: a world where financial transactions are as easy and instantaneous as sending a meme to your best friend. Sounds futuristic, right? Well, welcome to the Finternet, where finance is not just about numbers and ledgers; it’s about freedom, innovation, and accessibility.

The Finternet is a revolutionary concept that aims to create a seamless financial ecosystem, much like the Internet did for information sharing. It’s about making financial services universally available, interconnected, and user-centric. Whether you’re a tech enthusiast or someone just looking to manage money more efficiently, the Finternet is set to change the way you think about finance forever.

In this deep dive, we’ll explore what makes Finternet tick, how it’s poised to disrupt traditional financial systems, and why it’s the financial system for the future. So buckle up, because we’re about to embark on a journey into the world of tomorrow’s money! 💪💸

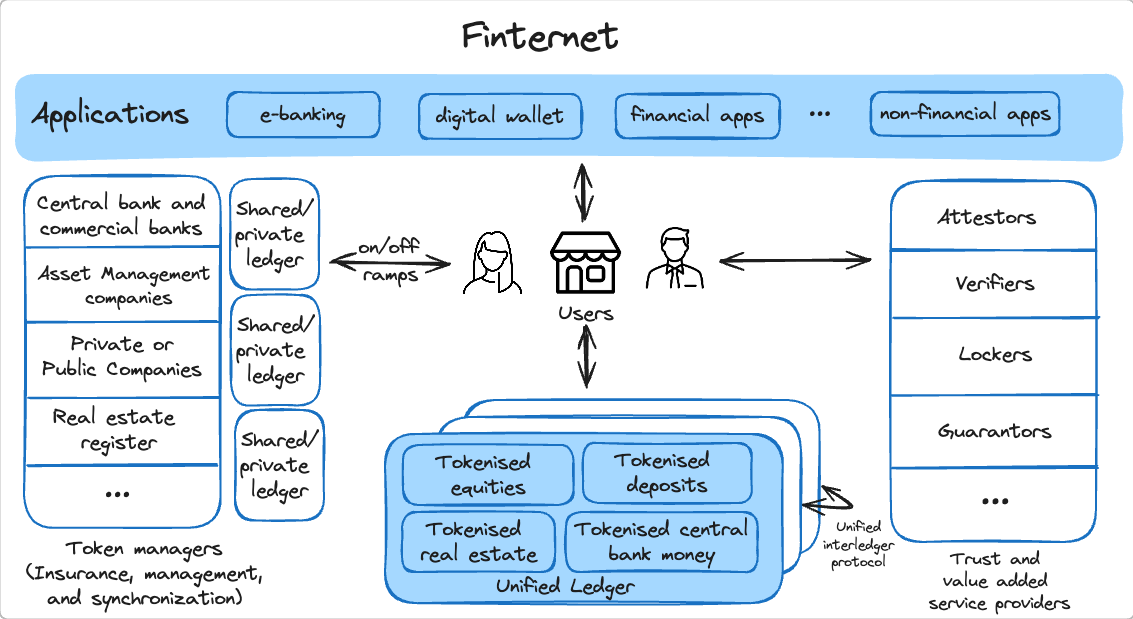

At its core, Finternet is a network of interconnected financial ecosystems. Imagine if all your financial services—banking, investing, budgeting, and more—were connected seamlessly, allowing for instant transactions, complete transparency, and unparalleled accessibility. That’s the vision behind Finternet.

Unlike traditional financial systems, which can often feel clunky and outdated, Finternet leverages cutting-edge technology to bring you a finance experience that’s not just efficient but genuinely enjoyable. It’s like having the entire financial world at your fingertips, 24/7.

Here’s what sets Finternet apart:

Interconnectivity: Just like the Internet connects various websites and services, Finternet aims to connect diverse financial ecosystems, enabling them to interact seamlessly. It’s about breaking down silos and creating a unified financial experience.

User-Centric Design: Finternet is all about you. Its architecture is designed with the end-user in mind, ensuring that financial services are intuitive, accessible, and tailored to individual needs.

Universal Access: No matter who you are or where you are in the world, Finternet is designed to be accessible to everyone. It’s about democratizing finance, making sure that everyone has the opportunity to participate in the global economy.

Efficient and Cost-Effective: Say goodbye to exorbitant transaction fees and lengthy processing times. Finternet is built to offer financial services that are fast, affordable, and hassle-free.

Finternet stands on three powerful pillars that define its purpose and operation:

In the traditional financial world, systems and services are often designed with the institution in mind, leaving the user to navigate complex processes and interfaces. Finternet flips this script by putting the user at the center of its design.

Imagine a financial ecosystem where everything is tailored to your needs. From personalized financial advice to AI-driven investment strategies, Finternet offers a bespoke experience that adapts to your unique financial situation. It’s about empowering you to take control of your financial life with confidence and ease.

Key Features:

Personalized Dashboards: Customize your financial dashboard to see the information that matters most to you—track spending, manage investments, and monitor financial goals all in one place.

AI-Driven Insights: Utilize machine learning algorithms to get tailored financial insights and recommendations, helping you make smarter financial decisions.

Seamless User Experience: Enjoy an intuitive interface that makes navigating your finances a breeze. No more complicated processes or confusing jargon—just simple, straightforward finance.

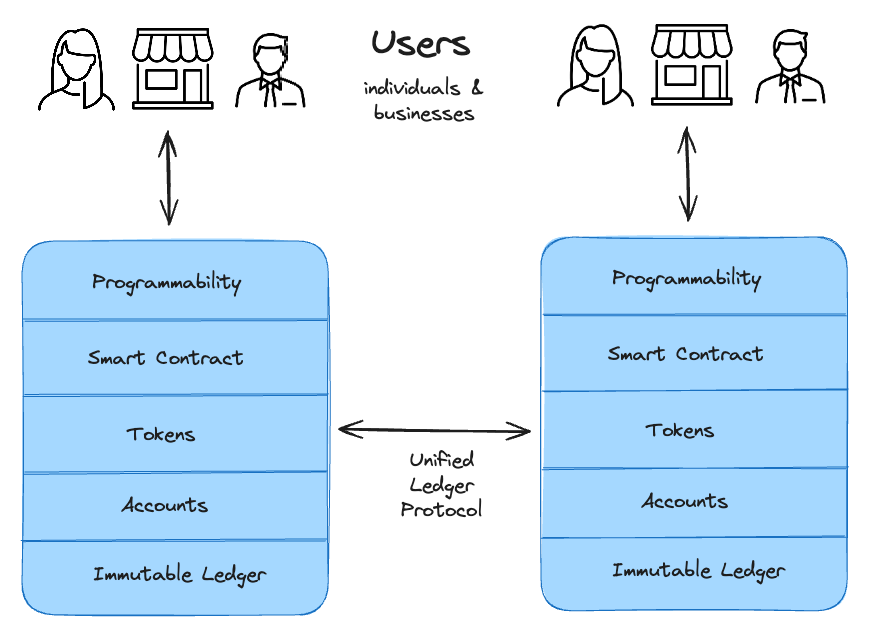

The financial world is often fragmented, with various systems and services operating in isolation. Finternet aims to unify these disparate elements into a single, cohesive network that offers a seamless experience.

Finternet’s Unification Strategy:

Cross-Platform Integration: Whether it’s your bank account, investment portfolio, or budgeting app, Finternet brings everything under one roof. Say goodbye to juggling multiple apps and platforms.

Interoperability: Different financial systems often struggle to communicate with each other. Finternet solves this by implementing standardized protocols that ensure smooth interactions between various financial services.

Comprehensive Financial Solutions: From payments to loans to investments, Finternet offers a one-stop-shop for all your financial needs, simplifying your financial life.

Accessibility is a fundamental principle of Finternet. The goal is to ensure that everyone, regardless of location or socioeconomic status, has access to world-class financial services.

How Finternet Achieves Universality:

Global Reach: Finternet is designed to operate across borders, providing financial services to anyone, anywhere, anytime. It’s about removing barriers and creating opportunities for all.

Inclusivity: By leveraging technology, Finternet aims to include underbanked and underserved populations, offering them a chance to participate in the global economy.

Language and Cultural Adaptation: Finternet adapts to local languages and cultural norms, ensuring that its services are relevant and accessible to diverse populations.

To truly appreciate the transformative power of Finternet, it’s crucial to understand the technological framework and mechanisms that drive this innovative financial system. Let’s break it down:

Finternet’s architecture is built on cutting-edge technology designed to support its vision of a connected, user-centric, and universal financial ecosystem. Here’s a look at some of its core components:

Decentralization: At the heart of Finternet lies blockchain technology, which enables decentralization. This means that no single entity has control over the entire network, ensuring transparency and reducing the risk of fraud or manipulation.

Immutability: Once data is recorded on the blockchain, it cannot be altered. This immutability provides an unparalleled level of security and trust for all transactions.

Smart Contracts: These are self-executing contracts with the terms of the agreement directly written into code. They automatically execute transactions when predetermined conditions are met, eliminating the need for intermediaries and ensuring efficiency.

Transparency and Trust: DLT allows all participants in the network to access a shared, immutable ledger. This transparency fosters trust among users and enables real-time auditing of financial activities.

Faster Transactions: By removing intermediaries and enabling peer-to-peer transactions, DLT significantly speeds up transaction processing times, making it possible to complete transactions in seconds rather than days.

Tokens play a crucial role in the Finternet ecosystem, serving as the digital representation of value that can be transferred across the network. Here’s how they work:

Asset Representation: Tokens can represent a wide range of assets, from traditional currencies and stocks to digital goods and services. This flexibility allows for seamless transactions and asset management within the Finternet ecosystem.

Programmable Money: Tokens are not just digital representations of value; they can also be programmed to perform specific functions, such as conditional payments or loyalty rewards. This programmability opens up endless possibilities for innovation and customization.

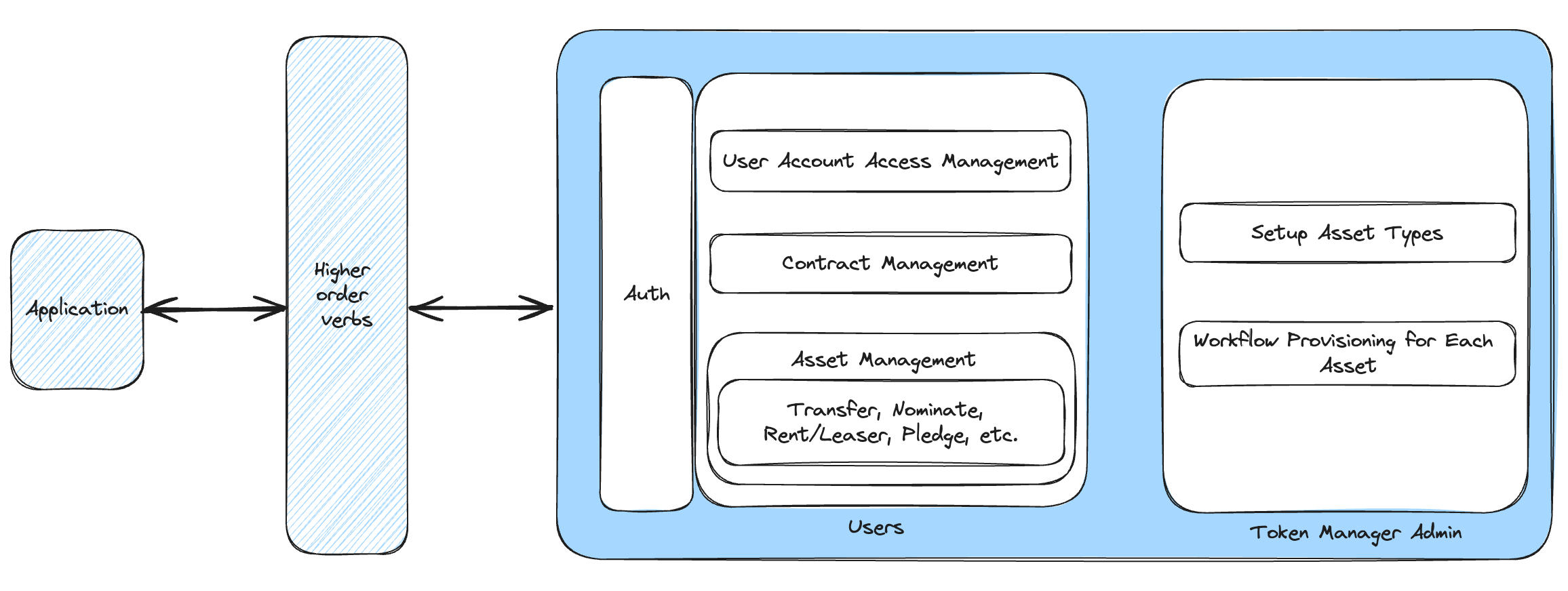

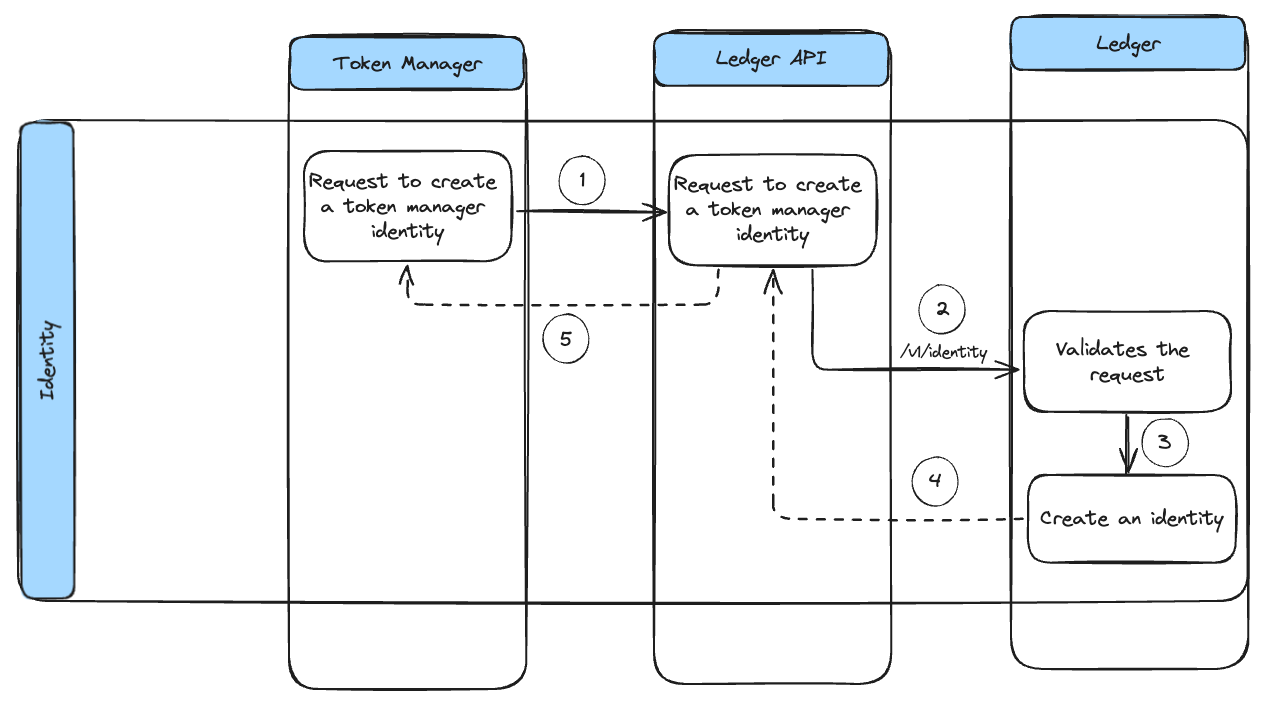

Issuance and Management: Token managers are responsible for issuing, managing, and tracking tokens within the Finternet ecosystem. They ensure that tokens are distributed and used according to the established rules and regulations.

Security and Compliance: By leveraging blockchain technology, token managers provide robust security measures to protect tokens from theft or misuse. Additionally, they ensure compliance with regulatory requirements, enhancing trust and legitimacy in the system.

The Unified Interledger Protocol (UILP) is a critical component of Finternet, enabling seamless interactions between different financial systems and platforms. Here’s how it works:

Cross-Platform Communication: UILP facilitates communication between various financial systems, allowing them to share information and conduct transactions without friction. This interoperability ensures that users can access and manage their finances across different platforms effortlessly.

Standardized Protocols: By implementing standardized protocols, UILP ensures that all financial services within the Finternet ecosystem can interact seamlessly, regardless of their underlying technology or infrastructure.

Bridging Blockchains: Finternet leverages UILP to enable transactions between different blockchains, creating a truly interconnected financial ecosystem. This capability allows users to move assets across chains without the need for intermediaries or conversion processes.

Scalability: UILP supports high transaction volumes and can scale to accommodate growing demand, ensuring that Finternet remains efficient and responsive as it expands.

Security and privacy are paramount in the Finternet ecosystem. Verifiable and portable credentials play a crucial role in ensuring that users’ identities and data are protected. Here’s how they work:

User Control: Finternet empowers users to manage their identities, reducing the risk of data breaches and identity theft. By leveraging decentralized identity management, users can control who accesses their information and under what conditions.

Privacy and Security: User credentials are stored securely on the blockchain, ensuring privacy and protection from unauthorized access

. Users have the power to grant and revoke access to their information, maintaining control over their digital identities.

Seamless Verification: Finternet utilizes portable credentials that can be easily verified across different platforms and services. This enables users to seamlessly access financial services without the need for repeated identity verification processes.

Cross-Border Functionality: Portable credentials ensure that users can access Finternet services regardless of their location, making it a truly global financial ecosystem.

Artificial intelligence is a driving force behind Finternet’s user-centric approach. AI technologies enable personalization and automation, enhancing the user experience and optimizing financial services.

Tailored Recommendations: Finternet’s AI algorithms analyze user data to provide personalized financial insights and recommendations. Whether it’s investment strategies, budgeting tips, or savings goals, AI ensures that users receive advice that aligns with their unique financial situations.

Adaptive Learning: As users interact with Finternet, AI systems continuously learn and adapt, refining recommendations based on changing circumstances and user preferences.

Streamlined Operations: Finternet leverages AI to automate routine financial tasks, such as transaction categorization, bill payments, and portfolio rebalancing. This automation reduces manual effort and frees up users to focus on strategic financial decisions.

Proactive Alerts: AI-driven alerts notify users of important financial events, such as payment due dates, market fluctuations, and investment opportunities. This proactive approach ensures that users stay informed and make timely decisions.

Traditional finance systems have been around for centuries, and while they have served their purpose, they come with significant limitations:

High Transaction Costs: Fees for cross-border transactions and currency conversions can be prohibitively expensive.

Limited Accessibility: Many people, especially in developing regions, lack access to basic financial services.

Slow Processing Times: Transactions can take days to clear, leading to inefficiencies and delays.

Complex Regulations: Navigating the maze of financial regulations can be challenging for businesses and individuals alike.

Finternet offers a fresh perspective on finance, addressing the shortcomings of traditional systems with innovative solutions:

Low Transaction Fees: By leveraging digital assets and decentralized networks, Finternet reduces transaction costs significantly.

Global Accessibility: Finternet is designed to be inclusive, providing financial services to anyone, anywhere, regardless of location.

Instant Transactions: Say goodbye to waiting days for transactions to clear. Finternet ensures instant processing and settlement.

Simplified Compliance: Through automated processes and smart contracts, Finternet streamlines regulatory compliance, making it easier for users to navigate.

One of the most significant challenges in today’s financial landscape is the lack of financial literacy. Many people struggle to understand basic financial concepts, which can lead to poor decision-making and financial instability.

Finternet aims to bridge this gap by:

Providing Educational Resources: Finternet offers a wealth of resources, from tutorials to interactive tools, to help users understand and manage their finances better.

Gamifying Financial Education: By turning financial education into a fun and engaging experience, Finternet makes learning about finance accessible and enjoyable for everyone.

Promoting Financial Empowerment: By equipping users with the knowledge they need, Finternet empowers individuals to take control of their financial futures confidently.

Gen Z is a generation that grew up with technology at their fingertips, and they are quickly becoming a driving force in the financial world. Finternet recognizes the importance of catering to this tech-savvy demographic by offering features and services that resonate with their values and preferences.

Embracing Digital Currencies: With a keen interest in digital currencies, Gen Z is drawn to Finternet’s support for cryptocurrencies and digital assets.

Prioritizing Sustainability: Gen Z is passionate about sustainability and ethical finance. Finternet aligns with these values by promoting transparent and responsible financial practices.

Encouraging Financial Independence: Finternet’s user-centric design empowers Gen Z to take control of their finances, fostering independence and confidence.

As the world shifts towards sustainable development, the financial industry must play a pivotal role in supporting environmental and social goals. Finternet is at the forefront of this movement, promoting sustainable finance practices that align with global objectives.

As the world moves towards sustainable development, the financial industry must play a crucial role in supporting environmental and social goals. Finternet is at the forefront of this movement, promoting sustainable finance practices that align with global objectives.

Key Initiatives:

Supporting Green Investments: Finternet encourages investments in sustainable projects, promoting a greener economy.

Enhancing Transparency: By leveraging blockchain technology, Finternet ensures transparency in financial transactions, reducing the risk of fraud and corruption.

Fostering Ethical Finance: Finternet supports ethical investment practices, ensuring that financial activities contribute positively to society and the environment.

Finternet’s commitment to sustainability extends beyond financial transactions. By promoting responsible finance practices, Finternet aims to make a positive impact on the environment and society as a whole.

Reducing Carbon Footprint: Through digital transactions and decentralized networks, Finternet minimizes the environmental impact of traditional banking systems.

Empowering Communities: By providing access to financial services in underserved areas, Finternet empowers communities and fosters economic growth.

While Finternet offers numerous benefits, it’s essential to address potential challenges to ensure a smooth transition from traditional systems. Here are some common pitfalls and how Finternet tackles them:

Security Concerns: Finternet employs advanced encryption and blockchain technology to safeguard user data and prevent cyber threats.

User Adoption: By offering user-friendly interfaces and educational resources, Finternet aims to make its services accessible to everyone, regardless of their technical expertise.

Regulatory Compliance: Finternet works closely with regulators to ensure compliance with local and international laws, promoting a secure and trustworthy financial environment.

Trust is paramount in the financial industry, and Finternet is committed to building a strong relationship with its users by prioritizing transparency, security, and user satisfaction.

Transparent Operations: Finternet operates with complete transparency, ensuring that users have full visibility into their financial activities.

User Feedback: Finternet values user feedback and continuously improves its services based on user suggestions and needs.

Finternet is more than just a technological innovation; it’s a vision for a better financial future. By embracing the principles of connectivity, inclusivity, and empowerment, Finternet is set to revolutionize the way we interact with money.

Whether you’re a tech-savvy Gen Z’er or someone looking to simplify your financial life, Finternet offers a world of opportunities at your fingertips. So why wait? Dive into the world of Finternet and join the revolution that’s transforming finance for the better.

Are you ready to be part of the future of finance? Welcome to Finternet! 🚀

References: